Create and Manage House Accounts

Learn how to create and manage House Accounts in the Back Office and use them for payments at the POS.

Introduction

House Accounts function as store-managed credit lines for frequent customers. Instead of paying at checkout, customers can charge purchases to their account and pay later on a schedule you define.

Key features include:

-

Credit-based tracking – Balances typically run negative to reflect debt owed.

-

Manual payments – Payments are collected and tracked outside of the POS.

-

Customer loyalty – Creates convenience and encourages repeat business

⚠️ Important: You cannot pay a House Account balance through the POS. All payments must be managed offline and manually applied in Back Office.

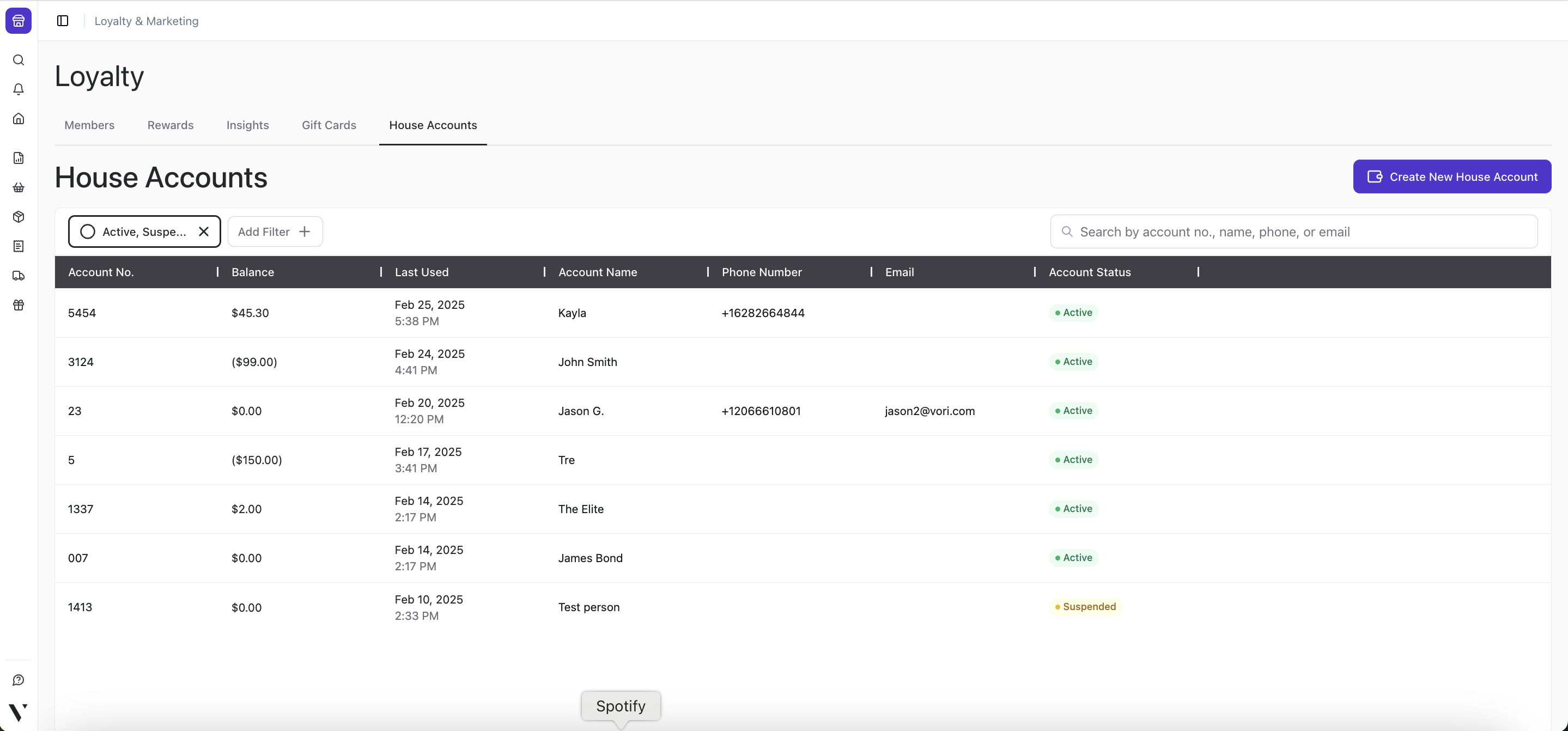

Accessing House Accounts in the Back Office

-

From the Back Office left-hand menu, go to Loyalty under the Loyalty & Marketing tab.

-

Select the House Accounts tab.

House Accounts Page Overview

-

Account No. - Unique ID number for account.

-

Balance - Total accrued debit or credit.

-

In the example above, John Smith has an accrued debt of ($99.00). Kayla has a credit of $45.30.

-

-

Last Used - Date and time of the last transaction linked to the account.

-

Account Name - Customer name attached to the account.

-

Phone Number & Email - Optional contact information linked to the account.

-

Account Status -

-

Active - Visible on the POS and can be attached to transactions.

-

Suspended - Visible on the POS but cannot be attached to transactions. The balance can still be modified.

-

Deactivated - Only visible in the Back Office when the “Deactivated” filter is applied. It cannot be attached to transactions, and the balance cannot be modified until the account is reactivated.

-

Manage House Accounts

Create a New House Account

-

On the House Accounts page, click Create New House Account.

-

Fill in all required fields marked with an asterisk ( * ).

-

Click Create House Account to save.

✏️ Note: Certain account information like phone number and email are not required to create a House Account and can be added later.

Modify a House Account Balance

Use the Modify Balance tool to record payments or offline charges not captured through the POS.

-

Select an account from the House Accounts page.

-

Click Modify Balance.

-

Choose an option and enter the amount:

-

Add to Balance / Apply Payment – Reduce debt by applying a payment.

-

Subtract from Balance – Add debt manually (e.g., offline transaction).

-

-

Under Reason for Balance Adjustment, enter a note for tracking.

Update a House Account’s Status

You can update an account’s status to control whether it can be used at the POS.

| Status | POS Access | Balance Changes |

|---|---|---|

| Active | Can be used | Yes |

| Suspended | Cannot be used | Yes |

| Deactivated | Hidden by default | No (must reactivate first) |

Suspend or Restore an Account

To temporarily disable or re-enable a House Account:

-

Open the House Account.

-

Click Suspend Account (or Restore, depending on status).

-

Add a reason in the confirmation window.

Deactivate an Account

To fully deactivate a House Account and prevent further balance changes:

-

Open the House Account.

-

Click Edit in the House Account Details section.

-

Select Deactivate, then enter a reason.

Reactivate a Deactivated Account

To restore a previously deactivated House Account:

-

Locate the account using the Deactivated filter.

-

Click Restore, then provide a reason for reactivation.

Charge a House Account at the POS

To charge a transaction to a House Account:

-

On the POS Payment screen, tap Other, then select House Account.

-

Scroll or search for the customer’s House Account.

-

Confirm the amount to be charged.

-

Tap Confirm Amount to complete the transaction.

Track House Account Transactions in Reports

Transactions tied to House Accounts appear in both:

-

End of Day Report

-

Sales Overview Report

View and Export House Account Statements

Give your house accounts a statement of their charges. This report details all transactions for a selected account within a specific date range, making it easy to bill your customers.

To access the statement:

-

Go to Reports > Finances tab.

-

Click House Account Statement.

-

From there, you can filter by Date Range and select the specific House Account you'd like to view.

-

Click Export to download a copy of the statement to print or email to your customer.

Best Practices for Managing House Accounts

Because payments are not collected digitally, it’s important to maintain strong internal processes:

-

Set clear payment terms for each customer.

-

Regularly review account balances in Back Office.

-

Use Suspend or Deactivate to pause usage on delinquent accounts.